Experienced Hard Money Lenders Atlanta: Funding Solutions for Property Buyers

Experienced Hard Money Lenders Atlanta: Funding Solutions for Property Buyers

Blog Article

Why Hard Money Lenders Are the Key to Fast Funding in Real Estate

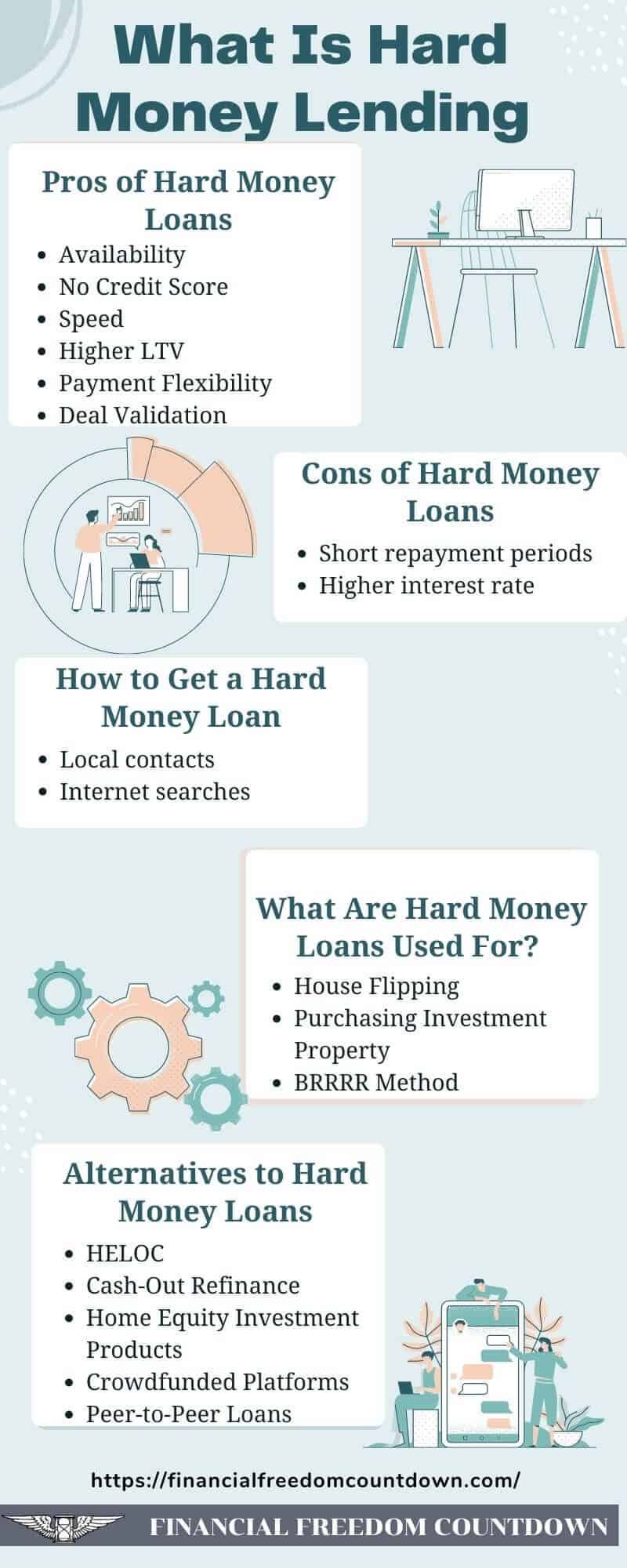

Hard money lenders play a crucial duty in this landscape by prioritizing the value of the home over the creditworthiness of the consumer, allowing deals to close in an issue of days. Understanding the subtleties of tough money providing might brighten why capitalists significantly transform to these resources for quick capital infusion.

What Are Hard Cash Lendings?

In the realm of real estate financing, hard cash lendings act as a beneficial alternative to conventional home loan choices. These financings are mainly backed by the worth of the residential property itself instead of the creditworthiness of the consumer. Generally provided by private financiers or companies, tough money car loans supply a fast opportunity for getting funding, particularly in situations where standard financing might be ineffective or inaccessible.

Tough money car loans are identified by their short-term period, often varying from a couple of months to a few years. The car loan amounts can vary significantly, depending on the residential or commercial property's value and the lender's standards. Rates of interest for tough cash finances are typically greater than standard car loans, mirroring the raised danger lenders tackle as a result of the reliance on residential or commercial property collateral.

The application procedure for hard cash fundings is generally accelerated, enabling borrowers to protect funding quickly, which is particularly useful in affordable property markets. Nonetheless, consumers need to be mindful of the terms and problems connected with these finances, as they differ substantially from common mortgage arrangements. Understanding the specifics of difficult cash car loans is crucial for making notified decisions in property investment.

Benefits of Hard Cash Lending

One significant benefit of hard money borrowing is the rate of accessibility to funds, which can be crucial in hectic property deals. Unlike standard financing choices that might include prolonged authorization processes, hard cash fundings can often be safeguarded within days, enabling financiers to take financially rewarding chances quickly.

Another benefit is the flexibility that difficult cash loan providers offer. These lending institutions are usually a lot more tolerant with their criteria, concentrating mostly on the value of the building as opposed to the debtor's debt background. This enables borrowers with less-than-perfect credit scores to acquire financing, making it an appealing option for lots of capitalists.

Furthermore, hard cash lending can assist in the procurement of distressed buildings needing immediate renovation. Investors can utilize the funds to acquire and refurbish residential or commercial properties swiftly, enhancing their market price and potential returns.

Just How to Get Approved For Hard Cash

Normally, loan providers will require a deposit, which can vary from 20% to 30%, depending on the job's viewed risk. A detailed evaluation of the residential property's condition and bankability is important, as lending institutions want to ensure their financial investment is protected. Customers should also be prepared to provide a detailed organization strategy that outlines the intended use the funds and the projected timeline for the project.

Additionally, having a solid track document in real estate investing can improve a borrower's reliability, even if it's not a formal requirement. Eventually, comprehending these requirements and preparing the needed documents can substantially enhance the qualification procedure for hard cash financings, helping with quicker accessibility to funds genuine estate ventures.

The Application Refine Discussed

Recognizing the demands for tough cash financings lays the foundation for navigating the application process successfully - hard money lenders atlanta. here The application procedure for tough cash finances is normally structured contrasted to traditional funding, allowing financiers to safeguard financing promptly

First, applicants need to prepare a detailed finance application that consists of individual and financial information, building information, and investment plans. Lenders typically prioritize the building's value over the borrower's credit reliability, so a detailed residential or commercial property evaluation is critical.

Next, possible debtors need to provide documentation such as bank statements, tax obligation returns, and proof of assets. This details aids lenders evaluate the borrower's financial stability and the task's usefulness.

Once the application is sent, lenders will certainly perform a due persistance process, which might consist of an analysis of the property's condition and possible resale value. This assessment normally takes a few days, enabling quick decision-making.

Case Studies: Success Stories

Genuine estate financiers usually seek out difficult money lendings to capitalize on time-sensitive possibilities, and countless success stories illustrate the effectiveness of this financing technique. With only days to act prior to the public auction, they secured a difficult cash lending, enabling them to acquire the residential or commercial property rapidly.

By obtaining a difficult cash financing, the financier closed the bargain within a week. The residential or commercial property was after that refurbished and refinanced right into a conventional home mortgage, enabling them to recover their first financial investment while retaining ownership and cash flow.

These instances emphasize exactly how difficult cash lenders supply the here agility and financial backing required to seize lucrative genuine estate opportunities, ultimately changing difficulties into profitable ventures for financiers.

Final Thought

Passion prices for difficult money financings are normally greater than standard fundings, showing the increased danger loan providers take on due to the reliance on residential or commercial property security.

The application process for difficult money car loans is generally accelerated, allowing debtors to safeguard financing quickly, which is specifically beneficial in affordable real estate markets. Unlike conventional lendings, tough money lenders concentrate mostly on the value of the building instead than the debtor's credit report rating or revenue level.Genuine estate financiers often seek out hard Extra resources money lendings to take advantage of on time-sensitive chances, and various success stories illustrate the performance of this funding technique. With only days to act before the public auction, they secured a hard cash funding, allowing them to purchase the residential property swiftly.

Report this page